Mechanics of Trading

Define, Define, Define – Sounds familiar. If not, It should.

Over the years we have spoken to many traders who are well aware of various trading techniques and have a fair understanding of technical and/or fundamental analysis. The one main dilemma they have faced is the ability to pull the different techniques together and develop a Mechanical Trading System that objectively helps them achieve their goals.

Mechanical Trading Systems will identify what, when and how much to trade every single time. Trading results can be consistent and are usually independent of traders’ emotions and state of mind. A Mechanical Trading System has the potential of having a huge edge in that its performance can be mathematically checked and evaluated.

Mechanical systems can be:

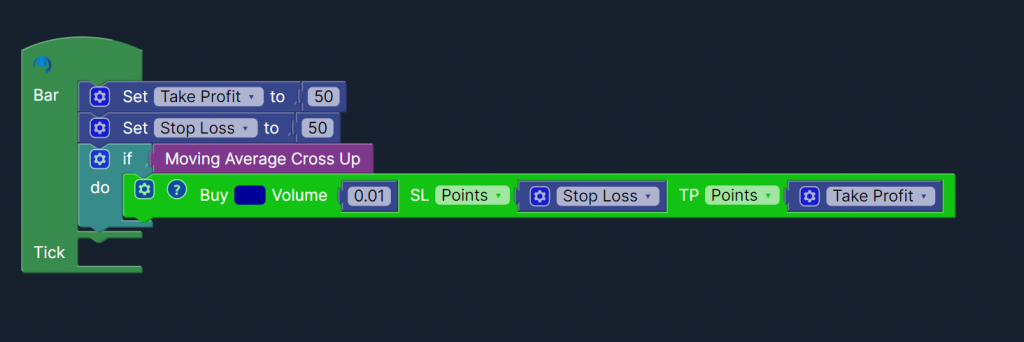

Automated – (EA’s) – the computer will automatically place the trade for you according to your set parameters.

or

Semi-automated – the computer will give you the signal according to your set parameters and then you place the trade.

Mechanical Systems are usually compared against Discretionary Systems where traders often use some sort of intuition to make a trading decision. We at Trade View Investments are advocates of Mechanical Systems because we are able to quantify results (it either works or it does not). In this article, we are going to touch on some of the basics of trading system development techniques.

Trading Rules Backed by Economic Rational

In his famous book Fooled By Randomness, finance professor Nassim Taleb explains how easily traders are often fooled by random price patterns/relationships that are seemingly genuine but have no predictive power when applied to real-time trading. For example in his book he referenced some interesting research – traders have been able to identify that butter production in Bangladesh has been the best predictor of S&P500 in a specific time period in the past.

Due to the mathematical characters of random figures, it is really easy to come up with many random trading rules that perfectly forecast the past and (therefore look genuine) can produce a different result when applied to real-life trading. So your first step is to make sure that whatever trading rule you are using it has some kind of economic rationale. For example – Momentum, Value, and Mean Reversion rules have a long history of performance and are academically and practically documented to have an economic rationale.

Simple is Best

You don’t need overly complicated trading rules to have a profitable system. Adding too many parameters to your trading system only increases the chance of Curve Fitting. Curve fitting is a situation when you force your system to adapt to historical data with minimal predictive power when traded live. Remember we are trading the NOW, not the past.

Test For Robustness and Stability

A robust trading system must work across multiple time frames and markets. Testing this can be done in a number of ways, but one simple idea is to run your system across markets with low or no correlation and then see how it performs in different environments. If your system can generate stable positive outcomes at a range of holding periods and across multiple markets and time frames, this means that you may be on to something good.

Another important factor is to check the system’s sensitivity to small changes in the parameters (i.e look back period in a moving average or RSI). If the results of your system dramatically change after a small change in parameters, chances are your system has been curve fitted.

Understand Optimization

A lot of system testing software gives you the ability to optimize your parameters. Optimization can be useful if done methodically but it can also be very misleading if one tries to over-optimize in order to get the best results. Optimization can often lead to curve fitting.

Avoid Cherry Picking

Testing a trend following a system in a period when markets have been strongly trending (ie.2013) doesn’t reflect the true performance of a system. To avoid this, you should make sure that your test data covers different stages of the economy and markets. Another important factor is spending some time in understanding the trading results under different market cycles.

Choose a Risk Management Strategy That Suits Your Personality

As stated in our previous article, risk management is the most important step in any trading activity. For any risk management to be effective, traders must make sure they are mentally comfortable with their risk management techniques. It is important that traders carefully consider their individual constraints and understand their own willingness and ability to take risks before devising any risk management strategies.

“Do you have a Trading Plan?”

In our Online Systems Building Program, we provide you with a comprehensive Trading Plan.

Look at Risk-Adjusted Returns

Just looking at absolute returns is not enough when you are trying to evaluate a system. Returns should be evaluated in a risk-adjusted context. A good way of working out your risk-adjusted return is to divide your monthly portfolio return by its standard deviations. Standard deviation is a measure of the dispersion of returns and shows how much the monthly returns deviate from their long-term average. The lower the standard deviation the better your systems.

Benchmark Your System

Compare your system performance with a simple benchmark. For example, if you are designing a complex trend-following system, compare its results with a simple moving average crossover system and see if the extra complexity creates a big enough edge (relative out-performance). Also, you need to know how often your system beats the benchmark.

Transaction Costs

Always include the transaction costs in your backtesting. Transaction costs such as commissions, spreads and slippage are proven to have a significant impact on the outcome of any trading system. Demonstrated results that do not account for transaction costs are simply misleading. We can assist in reducing transaction costs, contact us to find out how.

Trust Your System

You should recognize that trading systems are designed with the benefit of hindsight. This is true because you know what the market has done in the past when designing a system. It is important to recognize that past price patterns may not repeat in precisely the same way. It is not uncommon for any system to experience a long streak of losing trades when going live.

Therefore it is important to study your system under different scenarios and make sure that you can mentally and financially handle any turbulence. Once you have gone past this stage then you just need to trust and stick to your system.

Conclusion

Designing a Trading System is a delicate and time-consuming process. It requires a great deal of attention to detail and methodical thinking. When trading any system, it is YOU who needs to understand the way the system works, therefore we believe traders should learn to build their own systems rather than relying on others.

The main reason is that when the system breaks, you will need to fix it.

REMEMBER IT’S YOUR MONEY.

What we have covered above was just introductory. Trade View specialises in designing and developing trading systems. We offer a more in-depth approach to each of the above points plus many other rules and techniques in our Online Systems Building Program.

“Let us help you build your own Trading System”

Most retail traders are now automating their trades to build a systematic and disciplined approach to achieving their goals.

Build your very own automated trading system and receive a new model or concept straight from our Trading Desk every week.

Get access to our Online Systems Building PLUS program now!