‘Leverage is something people everywhere are going to look at’ – Jamie Dimon, CEO JP Morgan, April 2021

Dimon was speaking post JP Morgan’s impressive Q1 earnings reports this week, questioned on a relevant topic in 2021 – leverage.

The question was posed to him following the recent large scale blow-up of the infamous Archegos Capital LLC which has caused significant losses amongst multiple banks.

Aside from that, there have been several leverage changes for retail traders too, particularly here in Australia, with ASIC’s product intervention order putting caps on leverage available.

We thought it was a good time to break down what it is, what can go wrong and why it matters to you.

What is leverage?

Leverage is the use of a smaller amount of money to gain exposure to a larger amount of money.

In trading, it allows you to enter positions larger than the actual money you put in, by borrowing money – usually from your broker.

Example

You want to open a 1 contract long trade on the AUDUSD as you believe it’s going up.

To purchase 1 contract of AUDUSD outright, usually, you would need to put up $100,000.

This would represent a 1:1 leverage ratio.

However, if your broker provides you with 100:1 leverage then you would only need to outlay $1,000.

Now let’s say the AUDUSD trade goes in your favour and you make $1,000.

1:1 leverage would have provided a 1% return on investment, while a 100:1 leverage would have returned 100%!

Returns all of a sudden look far more attractive…

What are the benefits?

While still the same $ return on the single position, the % return with leverage is clearly much higher without also having to put up $100,000.

This can be helpful when you wish to enter several positions at the same time.

At Trade View we often talk about the importance of diversification, entering multiple positions across multiple assets/markets at the same time.

Without leverage, you will require extremely large amounts of capital to enter these positions, an amount that you may not have access to.

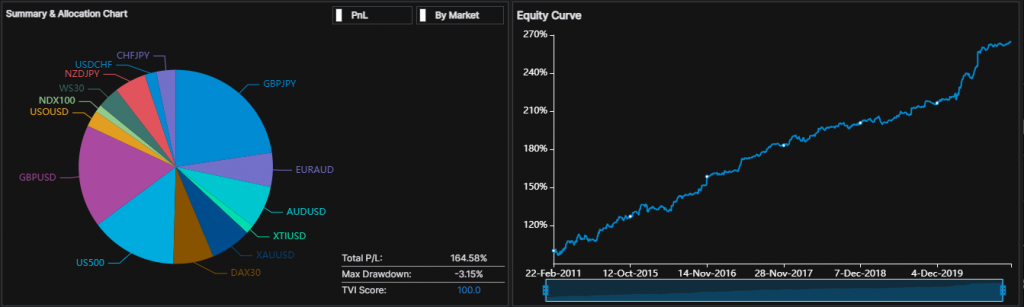

This image of X-Analyser shows a sample backtested portfolio created with 14 markets including FX, Commodities and Indices.

Returns can also be amplified; attractive for investors if you are running a fund or to hit your own investment goals.

A recent interview with a hedge fund manager in Shanghai explained how she turned to use leverage last year as she wasn’t attracting funds otherwise – and ended up with an industry-leading 258% for the year.

With professional risk and money management – more on that shortly – using leverage allows you the ability to trade multiple markets without having to put up too much of your own capital, yet still, achieve consistent returns.

Now let’s talk risks

In the example above we talked about when the trade went in our favour – unfortunately, this isn’t always going to be the case.

The 100% gain we talked about before could, on the other hand, end up a 100% loss (as well as a margin call, more on that shortly) if the trade ended up as a $1000 loss.

Whereas without using leverage (1:1 ratio) it would have been a meagre -1% loss on your capital.

Margin Call

Usually, you would have an account balance larger than the deposit amounts required to open your positions, this gives some breathing room for a potential drawdown on your capital.

You would likely receive a margin call from your broker when your account balance is close to going below the required margin (deposit for the trades).

Once a margin call is issued, if the trader is unable to bring their capital to the minimum requirements then the broker has the right to close all positions.

Gaps

Gapping is when the price of an asset opens higher or lower than the price it closed at on the previous day. Gaps can also occur intra-day but they are rarer.

Trading in large position size (through use of leverage) and market gapping past your stop loss, your initially planned ‘max risk’ for the trade could be exceeded.

In a severe case, it may lead to you owing money to the broker as the new price your trade gets closed at results in a loss greater than your account balance.

Over-leveraging

If leverage is mismanaged it can lead to being over-exposed and this is where Bill Hwang’s Archegos Capital LLC enters the article.

You may have read about this fund which blew up recently and as the dust has settled it appears this blow-up was over $20bn in just two days!

This is where the use of leverage has gone very wrong. In this case, it appears common traders traits of greed and poor risk management have assisted. Archegos were heavily leveraged and across multiple different brokerages (and these banks seemingly didn’t know this) – so when the stocks they held positions in suddenly took a huge hit, their losses were amplified and received several margin calls.

Whether it’s $20bn or $2,000, the same mistakes and margin calls can be made – and are made on a daily basis.

What can be done about it?

To combat the misuse of leverage, regulators around the world have been clamping down to restrict retail traders access.

This includes most recently here in Australia as ASIC brought about significant changes in March.

While at an institutional level, the U.S. Congress is currently probing the Archegos scandal and why banks provided so much leverage to lead to such significant losses – there are talks that new rules may come in place to prevent that from happening again.

What can you do about it?

Managing risk is the number one priority of professional firms like ourselves. We break down our exact risk and money management model in the Systems Building program.

It’s possible that every trader can make some profit on a day by day basis, but doing that consistently over the course of a year, then over the course of many years is the challenge. Protecting your capital should be the priority, not allowing emotions/greed to take over and leaving yourself over-exposed.

We have already touched on the importance of diversification but it also comes down to removing emotion. We believe the only way to do that is by having a systematic approach and automating your trading system. Being able to backtest your trading system, finding out the risk you are taking, the correct position sizing and correct leverage to use – before you actually trade your hard-earned money – is critical.

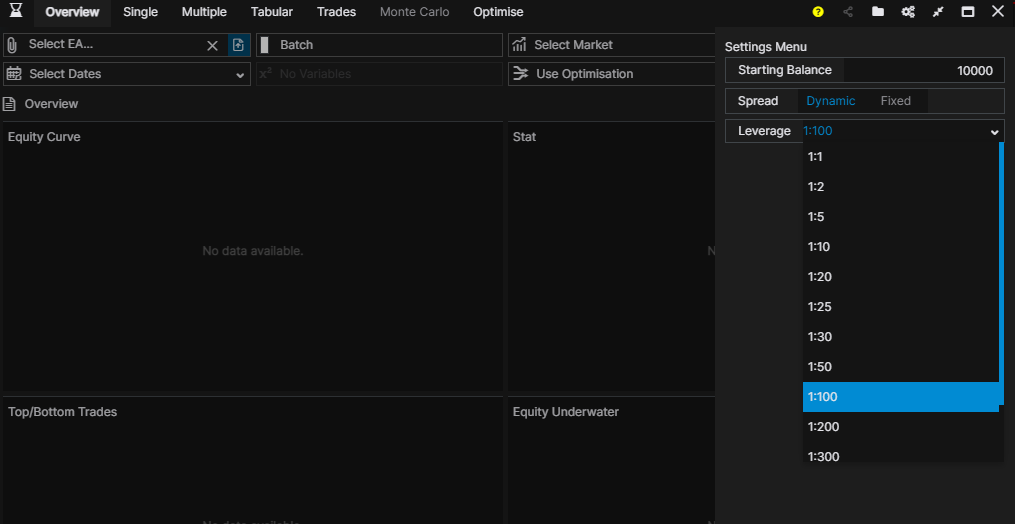

You will see on the image below the option to select your leverage amount for backtesting purposes within our X-Tester:

If you haven’t already, now is the time to start automating your trading strategies.

You can see how we and many others do that using Trade View X.

Our clients receive unlimited support to build their automated models and other aspects of their trading.