This article will be published in the Nov 2014 issue of Your Trading Edge.

Visual Bias when Trading

As a trader you must agree that trading rules and Technical Analysis (TA) in general appear to be far more accurate in the past than the present. For some reasons, the same RSIs, Moving averages, chart patterns etc… which have pinpointed excellent entry /exit points in the past, fail to perform as desired once we use them for live trading! Its like the markets are watching what we are doing?

The questions is, does the above happen because TA is generally good for forecasting the past and has no predictive power in the future? Or, is it something about us as traders not being able to choose the right trading idea and/or system?

As it turns out, TA is still a useful tool for some traders. In their recent study, David M Smith et. al.(2013) have demonstrated that fund managers who use TA are able to achieve consistently higher returns than those who don’t. There are also a wide range of academic research papers on the profitability of basic technical concepts such as trend and momentum. Menkhoff (2009) has shown that many professional traders, especially those who trade the currency markets, regularly use TA to exploit opportunities not explainable by the fundamentals.

So if TA still works, there must be something about our ability to distinguish between a desirable and an undesirable set of tools that don’t allow us to achieve our trading goals. The problem lies deep within our human roots and has to do with our biases and cognitive limitations. Technical analysts and in particular those who use subjective and discretionary methods, are subject to Confirmation and Hindsight biases.

Confirmation bias is when we systematically look for what confirms our prior beliefs and to ignore or undervalue what contracts our set perceptions. Naturally we want to avoid the discomforting feeling of contradiction (being wrong) and only seek to find confirmatory evidence (being right). A good example of this bias is when we are trying to ascertain a simple breakout strategy by looking at a chart. If the market keeps going to the direction of the breakout, we gladly count it as a success (after the fact), but if it fails-that is it reverses its direction after the breakout- we call it a Bull/Bear Trap (or some other fancy name that an educator has come up with and is now gospel) and all forget about the failure which has just happened. The point is by renaming the model we have shifted our attention from a failed breakout strategy to a now a successful Bull/Bear Trap! This doesn’t cause any harm when you are only visually inspecting the historical data, but it’s not so easy when you are in the midst of a live trade with your hard earned cash on the line.

In your eyes, a failed breakout simply means money lost. If it happens a few times in a row (which can and will easily happened due to the nature of the markets) you may start abandoning the strategy or even start questioning TA. Whereas if you had trained your mind to be bias free at the evaluation stage, you would have had a much better understanding of the true performance and characteristic of the strategy you were choosing and therefore be ready for it. This is easier said than done.

Confirmation bias will also make you take unjustified risks by holding disproportionate amount of your investment in a particular position. The constant positive feedback that your patterns have superior predictive power may convince you to religiously follow your opinion and ignore any contradictory news. By believing that the investment is a really good option, you may then build a large position and end up having an undiversified portfolio. This can ultimately lead to losses or excessive risks not rationally warranted for your portfolio.

A good starting point to overcome the confirmation bias is to have an objective set of criteria which can be mechanically back tested. If you can properly define your trading set ups and get the machine to correctly verify them, you have taken one big step towards avoiding this bias. Another important step is to actively look for conflicting opinions/data when you are making an investment decision. This is where you can use the social media to your advantage by actively discussing your ideas with those who think otherwise. Mistakes can always be made, but by gathering both positive and negative opinions, you will have a more complete picture about your investment decision before making any commitment.

If you are a chartist and mainly use discretionary techniques, I then recommend you flip the chart and see what you think when the chart is upside down. Logically, an unbiased buy signal in the original chart should convert to a sell signal in the flipped chart. But if it didn’t, chances are your original analysis was flawed or biased. This is particularly helpful for stock traders, as we have a natural tendency to seek price increases as opposed to declines when looking at the equities.

The second most important bias we as traders face is the hindsight bias. Hindsight bias is when we say “I knew it was going to happen “after actually seeing the result .It creates an illusion that the prediction of an uncertain event was easy whereas it really wasn’t.

It comes from our tendency to distort our judgment towards after the fact/event information. So that if I give you a set of questions about uncertain events (I.e. is the market going to consolidate, trend, reverse etc…) and give you the true answer at the same time, you would unconsciously distrot your analysis to arrive at a conclusion in line with the true answer as if it was obvious.

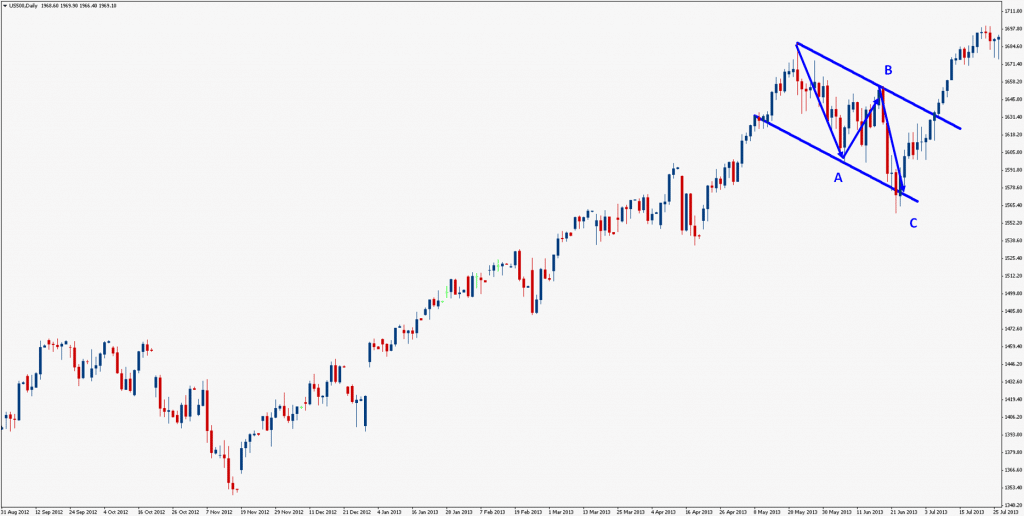

Let me give you an example, Chart 1 is the S&P500 in Aug 2013. Knowing what you know , you can easily classify the June-July move as a normal ABC correction or even a Flag which is a continuation pattern. You will then easily say that it was obvious that market was going to go up. Your chart pattern has perfectly worked (therefore confirmation bias is happy) and trading looks like an easy task.

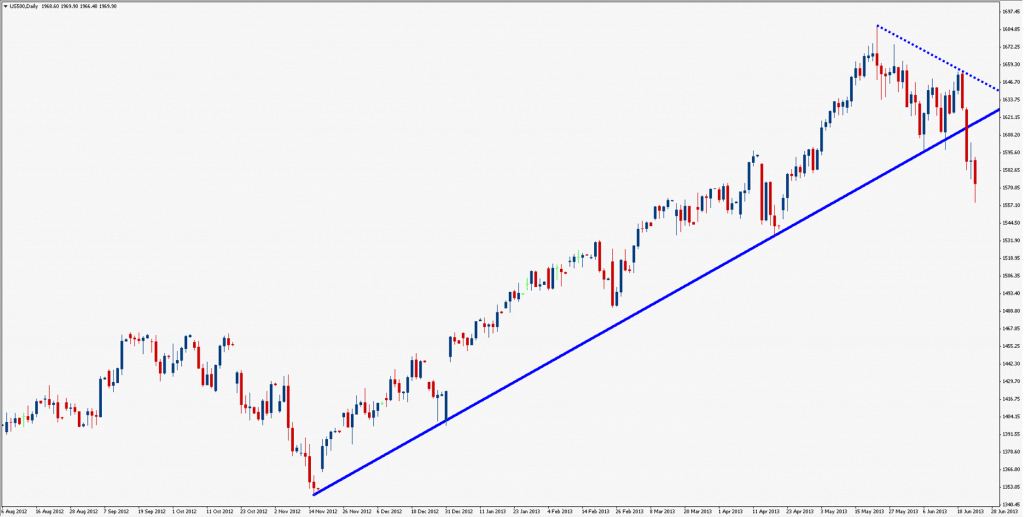

However Chart 2 is the same chart but without the benefit of the hindsight. Now what you see is a classic trendline breakout plus a sizable series of two lower lows and lower highs. Add to this the overbought condition of the markets back at the time and perhaps the media hype. Doesn’t the same chart that looked so obviously bullish ,look obviously bearish now ? Wouldn’t you want to go short ?

What you have just seen is hindsight bias in full force. It makes trading look much easier than it really is.

How do we fix this?

You need to realize that markets are uncertain. There can be as many bullish scenarios as there are for the bearish cases at any point in time.

To get a feel for this, I encourage you to open a chart and make a prediction for next Friday’s close. Then I want you to revisit your initial analysis, revise and record your new views every night without reading your views from the previous night. Come next Friday, write a commentary about the market and highlight the patterns, turns and twists as if you are trying to teach someone how to trade. Now compare this commentary of yours with your nightly observation and see how all of sudden everything is looking easy. You will also realize why most people are interested in analyzing the past rather the concentrating on the present!

To avoid this shortcoming as a trader, we need to have a solid definition of our entry/exit/money management/risk management rules that can be modeled and mechanically back tested without any bias. This allows for a robust walk through the market which in turn helps us survive the inevitable mistake and tough times. Just like here at Trade View, traders should be conscious of this bias, try to learn from their previous mistakes and build systems that allow you to evaluate the strategy to its full potential.

Unfortunately Confirmation and Hindsight biases are not the only ones affecting our investment decision making. Behavioural Finance in recent years, has documented many other biases that negatively impact our trading activities day in day out. But this is another topic altogether.

Ramin Rouzabadi, CFA, CMT

Trading Systems Analyst

Trade View Investments