In today’s day and age, many of the major economies and their respective markets are facing conditions we have never seen before. For the first time in history, we are witnessing interest rates below zero.

This new approach towards monetary policy has been coined the term ‘NIRP’ (Negative Interest Rate Policy). In this article we will explain where NIRP came from, why we are here, and what our traders are doing to monitor the situation and more importantly manage risk appropriately.

What is NIRP?

NIRP is the new frontier of monetary policy- whereby a central bank sets the benchmark cash rate for their respective currency to below zero percent.

In a normal interest rate environment (> 0 %), depositors earn interest on their savings.

However in a negative interest rate world it’s the other way around: instead of receiving interest on savings, banks will charge for the privilege of holding funds.

For those of you reading this for the first time this may sound bizarre, strange, and somewhat ridiculous. And maybe you are right.

NOTE: Currently only commercial banks are being penalised for depositing cash (with central banks), however should the situation get worse, the general public may be susceptible to such interest rate charges too.

Where There is Smoke, There is Fire!

It began in the dead of night ( well that’s what it felt like as nobody paid any real attention to it ) The first central bank to actually set its deposit rate below zero was the Riksbank (Swedish National Bank) back in July 2009 as a result of the Global Financial Crisis. The DNB (Danish National Bank) then followed suit in July 2012, however things really got moving when the ECB cut its rates.

In June 2014 – Mario Draghi announced ‘the ECB would do ‘whatever it takes’ to keep the Euro states together. At a time when no-one thought it was possible, Draghi announced the benchmark rate for the EURO region would be lowered to -0.1%, before once again cutting this to -0.2% a few months later.

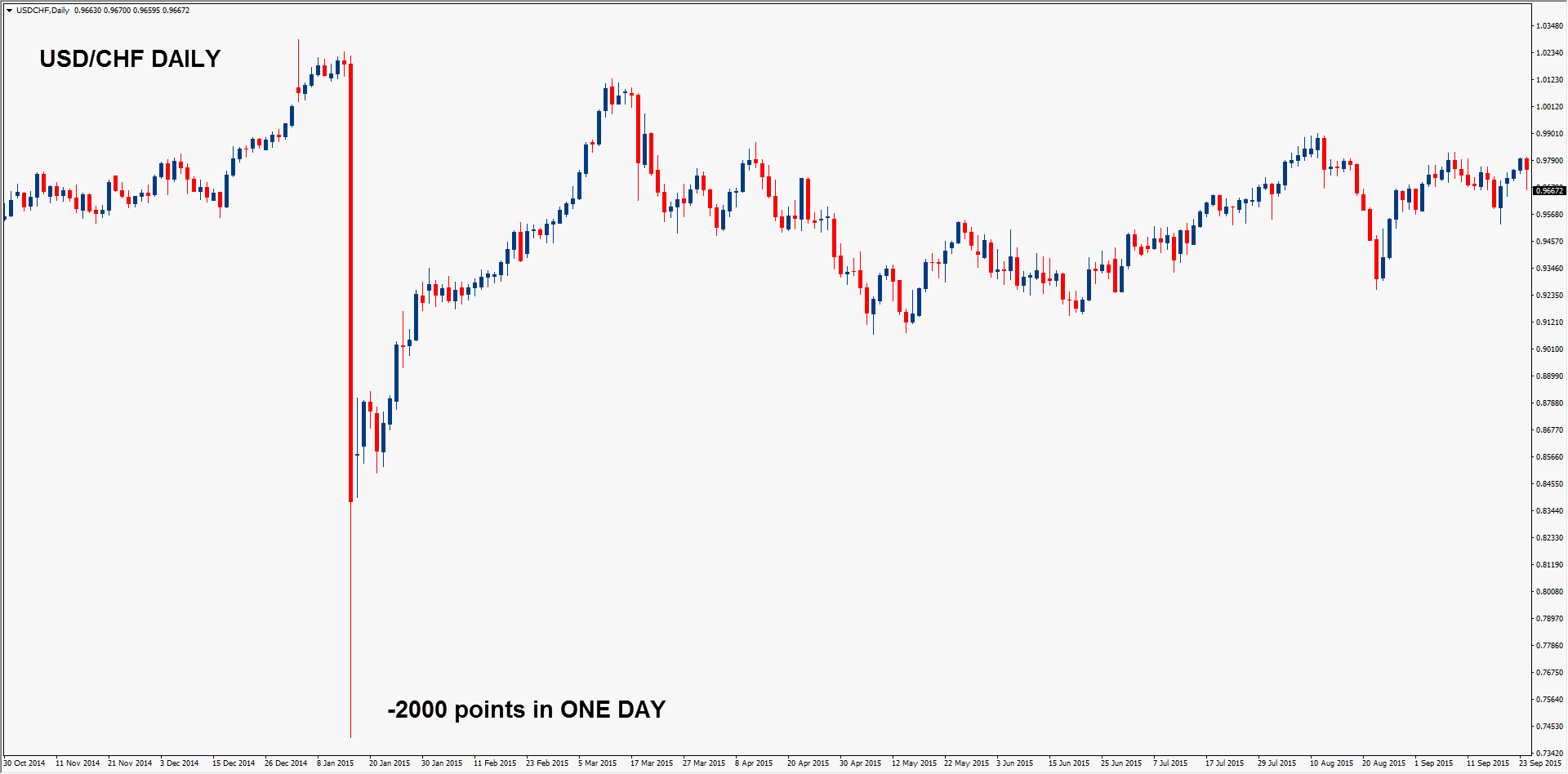

But the world REALLY started to pay attention when the Swiss cut rates in Jan 2015, and the shock SNB euro – depegging that came with it.

And most recently this year – when Japan also went under water.

Why NIRP?

Like monetary policy tools prior, central banks are employing NIRP in the hope it provides growth and helps stimulate economies. It comes on the back of:

- Long periods of zero percent interest rates, and

- Quantitative Easing (where central banks have printed more money)

Compared to the policies above, negative rates is so far the most controversial mandate as it is both unique and unprecedented.

What has been the effect of all of this?

In addition to stimulating growth, we mentioned earlier that NIRP decisions have been unique to each bank. To give some historical context- we have summed up the primary reason why each central bank favoured negative rates:

- The DNB reduced rates in response to capital inflows

- The SNB reduced rates to devalue the Swiss Franc

- The ECB has maintained they are fighting deflation whilst boosting inflation

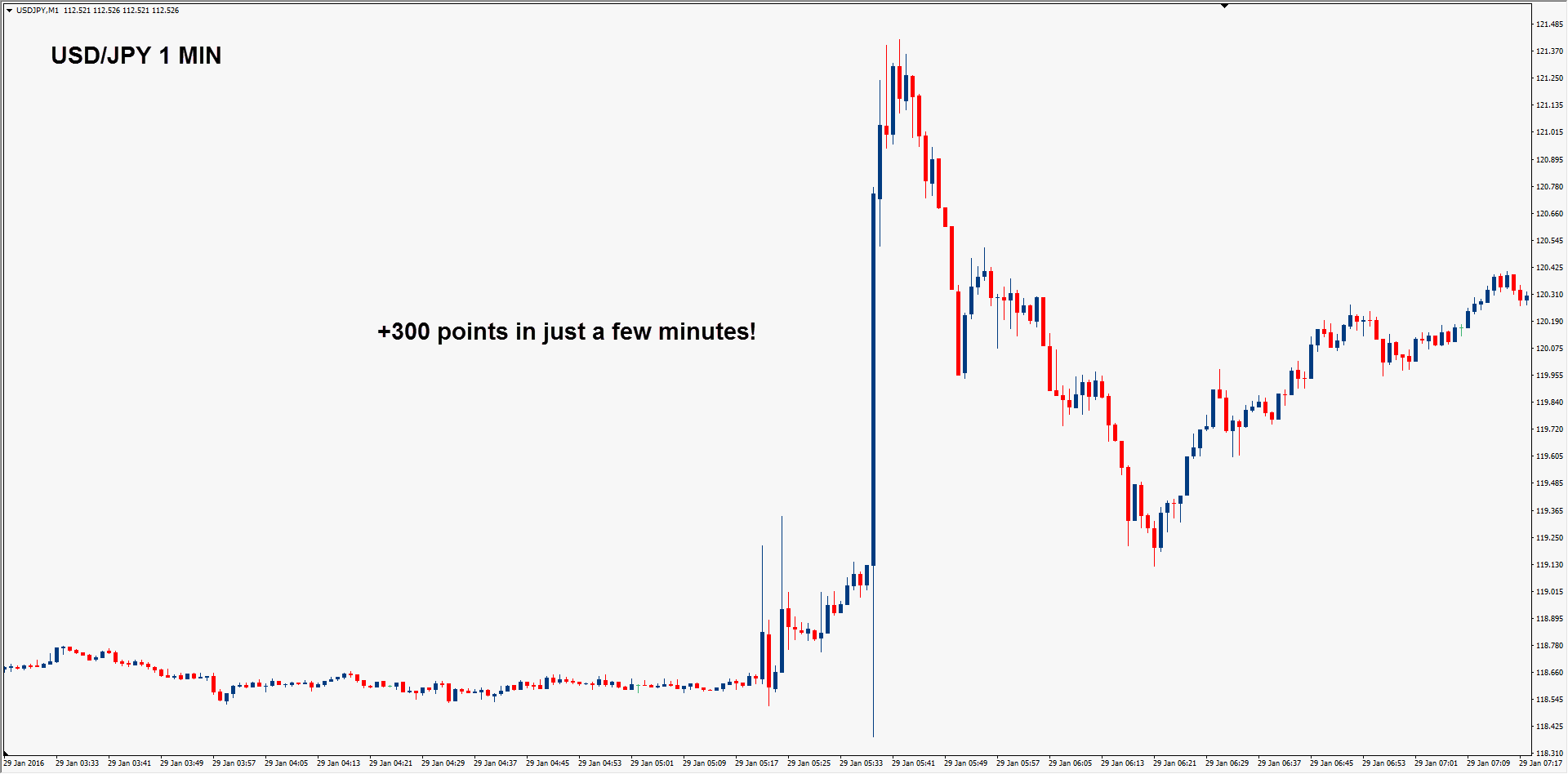

And then in January this year – in a shock decision the BoJ announced negative rates citing similar reasons to the ECB.

So, how does this relate to trading?

These type of events are when you need to be very careful in how you trade, there is a saying on dealing desks ‘Your idea could be right, but you could be wrong on the trade’

It basically relates to traders getting overzealous about what they think is right and go all in on the one trade.

- Sometimes it works out and you make a lot of money, but

- Most of the times it does not, and you blow up your account

‘Be honest with yourself – which one are you?’

So what’s important in a situation like this?

“DIVERSIFICATION”.

If you don’t already do it, it might be time to start considering putting some diversification in place. If you are a regular reader of our articles you will note that we constantly say “BE PREPARED”.

Now is the time more than ever that you should truly understand what is actually going on in the markets and put some strategies into action and take this seriously. Shock decisions could become the norm and you could start seeing more moves like this:

One such strategy to counter such events might be to cover current positions with options. While another could be to have a NET exposure in your portfolio – which would mean you could still have exposure to the direction you think the market will go and also cover a little in the opposite direction just in case.

How will this help you ask? In simple terms you protect yourself if the market does not go in your favour and you hopefully limit your losses, then if you are quick enough you can square and reverse your positions to go in the right direction.

But then you ask, what if I am right and I have protection on the other side?

I will not make as much money.

If you are the type of person who asks this question then I would reply with a simple you are being too GREEDY. Situations like this need to be given the respect they deserve as they are the cause of huge momentum shifts in the markets and change.

So ‘BE PREPARED’

While others try to hit the ball out of the ball-park and show you charts about trades that should have worked because of a magical indicator, here at Trade View we concentrate on protecting what we have and try to identify the shift in market sentiment before it occurs by generating new ideas and trading strategies so that we can profit from events like these.

Dont usually leave comments but this answered alot of questions, interesting Denmark and Sweden started all of this. I thought something was wrong when interest rates started going below zero in Europe. do u think the US will go negative? interesting read thanks.

Hi Mitch, we don’t expect the US to go negative anytime soon, but markets are definitely putting the FED to the sword. We’ve been eluding to this in our past articles & member portal, and will speak more about this in next month’s newsletter out soon. For the time being- we expect there to be more surprises to come out of the US this year especially with on-going elections.