Well Q1 is a wrap – and what a start to the year for markets. A combination of one of the most hawkish Fed’s in modern history and an intensifying / changing geopolitical landscape has provided a cocktail for many ‘non-normal’ market moves. Despite all of this, it appears there is still room for meme stocks to make a comeback! The Yen has been breaking multi decade levels and destroying many ‘martingale’ systems in its wake… not just that, but Japanese retail traders have also been in their biggest ‘long’ position on records – ouch! Meanwhile, other speculative risk assets like BTC have seen any rallies fade back down, as markets come to terms with the hawkish macro environment.

The rise of the USD

Many suggested the USD was dead, done, finished. BTC was ready to replace the USD as the world’s reserve currency as central banks continued to ‘print money (they actually don’t).

Anyway, the reality is that this hasn’t been the case. The USD has been trending up for more than a year now and the DXY looks set to continue its gains, north of the psychologically important 100 handle.

If you are wondering what is driving the moves seen in FX right now, look no further than bond markets. For example, the USDJPY has gone parabolic, hitting new 20 year highs. Why? The main reason is a significant policy divergence between the Fed and the Bank of Japan. The former is ultra hawkish right now while the BoJ is the opposite! The BoJ capped 10-year Japanese yields at 0.25%, as other G10 central banks raise interest rates. This is posing a significant headwind to the JPY – take a look at the spread between 10 years of US and Japanese yields, now at its widest since mid-2019.

Trying to pick a top of a move as we’ve seen is not encouraged, albeit perhaps the 130 handle could provide a ‘short term blowoff’ point.

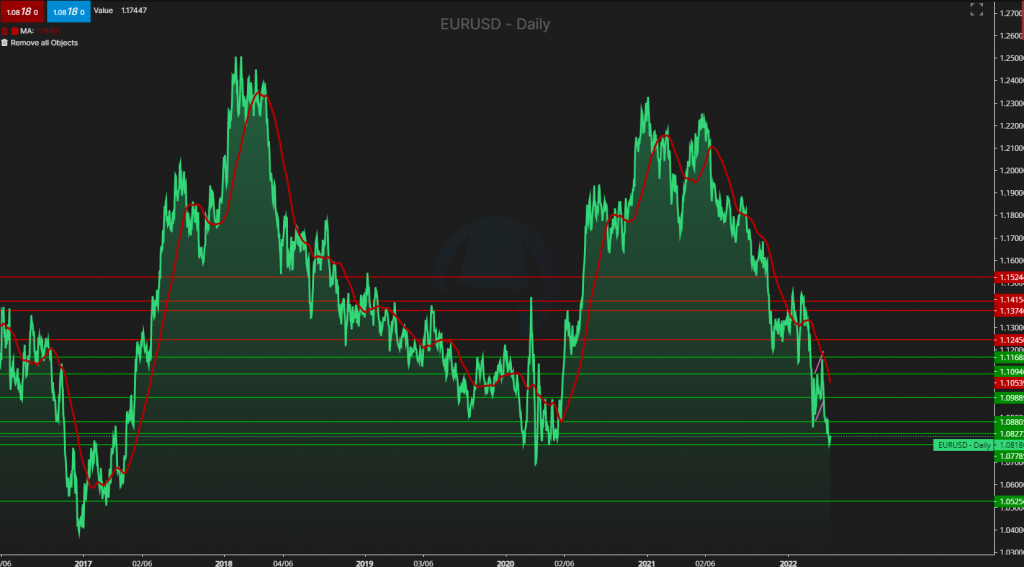

Elsewhere in the world of FX, the Euro is also suffering against the greenback, posting new yearly lows over the past weeks. Once again, this can be viewed as central bank policy divergence, given the ECB’s dovish stance – slightly hawkish stance – last week’s dovish U-turn. It is now being argued that a test of parity against the USD from here is no longer a low probability risk. Could this trigger a currency crisis of confidence? Surely this is the last thing the ECB needs. They need to start providing markets with encouragement that they are ready to raise rates.

To continue reading this article…

This Newsletter is FREE to Trade View Clients.

If you are an existing client please LOG IN.

Our Monthly Newsletters

Unlimited access

A$9.90/mo.

No lock-in contracts.