September proved to be tricky yet again for global equities as the S&P 500 recorded its worst monthly performance since the March 2020 Covid pandemic crash. There appears to be a divergence between central banks – a more Hawkish Fed v super Dovish ECB. China continues to cause economic concerns, both from a supply chain perspective and hints at contagion from the collapse of Evergrande. Regulation continues to be the key theme in cryptos and will any other countries follow El Salvador’s lead in adopting Bitcoin as an official currency? Plenty to discuss and look ahead to in this month’s newsletter.

Latest Market Stories

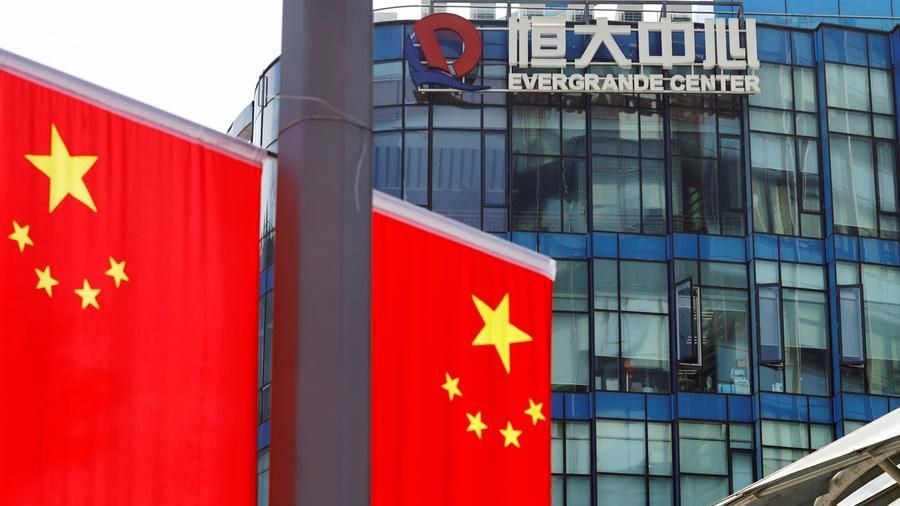

Evergrande & contagion

There has been significant talk about the potential collapse of China’s Evergrande Group and the consequences it may bring. As you may have read, Evergrande is China’s second-largest real estate developer and with $300bn in debt, the world’s most indebted company. Their failure to meet obligations of payments to bondholders in recent times has seen their share price decline by over 80% this year, while bonds have been downgraded by rating agencies to levels suggesting default is likely.

This has thrown a new spotlight on China’s entire real estate sector – with reports showing that apartment prices in two of the country’s major cities (Shenzhen and Beijing) are ~55 times greater than the average yearly income. To put this into perspective, prices in Japan were 18 times annual income during their economic bubble in the 1990s.

The situation in China has been steadily worsening for the past months, with hundreds of protestors gathering outside of Evergrande headquarters in Shenzhen demanding to be paid for overdue loans and other obligations. The group claims that it cannot liquidate assets fast enough to pay its large debts due to “tremendous pressure” on cash flow, but this has left many investors, homebuyers and even employees fearing large losses of their own. The underlying cause of the situation is undoubtedly years of borrowing to fuel fast growth, but recent crackdowns from Beijing to tighten borrowing in the sector have caused unprecedented problems for those most indebted. These crackdowns are a direct response to the county’s booming property sector, which some have claimed to be a bloated speculative bubble with the potential for far-reaching repercussions in the event of a crash. In China, the responses had been mixed with some feeling “numb about all this tightening”, while others have described new measures as “draconian”. When you combine this with an already battered economy following the effects of Covid-19, it is easy to see how problems could mount so quickly.

However, despite all of these hardships, well-managed companies should be able to weather challenges through thorough planning and strategy. The issue here is that Evergrande has long been known as a heavily indebted company – in fact, its use of leverage has helped it grow to the second-largest property developer in China by sales during an incredible boom for the sector. Leverage refers to the use of debt to acquire assets, invest or undertake a new project. In the modern economy, leverage has enabled unparalleled growth for thousands of companies seeking to grow their market share exponentially. While leveraging can be an incredibly effective tool when harnessed correctly, it can also open companies up to a huge amount of risk. Just like a trader who uses leverage to increase their capital, if markets move in your favour you amplify your profits, but if they move against you then your losses can quickly pile up. In other words, leverage is a double-edged sword that should not be used lightly. For Evergrande, it appears this truth has been realised too late to change course.

What now remains to be seen is the true fallout from this event. Markets looked to have recovered from the initial shock on Monday 20th September, with Wall Street making modest gains the next day and responding positively on Wednesday to the group’s announcement that a deal had been struck for domestic debt payments. This deal seems to have calmed immediate contagion concerns and at this stage, it appears that this will not be another ‘Lehman moment’ for the global economy. Instead, it could be closer to what happened with LTCM (Long-Term Capital Management), with many sources expecting Beijing to take control of the situation.

But the inherent problems raised by this situation still exist. The financials of Chinese companies are notoriously secretive, making it more difficult to assess situations objectively and leading to multiple controversies over the years – take a look at Alibaba or Luckin Coffee. International market integration provides many benefits, but it also means that domestic crises are rarely contained to a single country which increases the risk of contagion. Poorly financed companies will inevitably find ways to increase leverage up until the point it becomes untenable. It is worrying to think that, while Evergrande may not be a ‘tipping point’ as such, it may take a full-blown crisis to force change over issues that are perpetually plaguing the global financial system.

To continue reading this article…

This Newsletter is FREE to Trade View Clients.

If you are an existing client please LOG IN.

Our Monthly Newsletters

Unlimited access

A$9.90/mo.

No lock-in contracts.